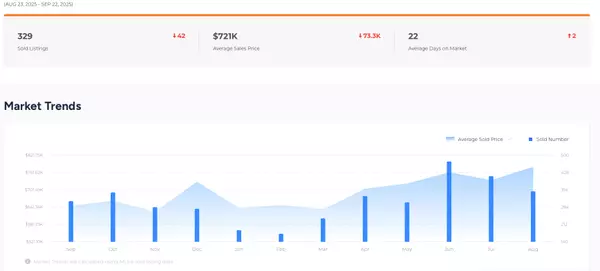

Weekend Market Talking Points – Affordability on the Move

August 15, 2025 | Joe Johnbosco Team

Mortgage rates are trending lower, a Fed rate cut is highly likely in September, home prices are softening in several markets, and buyers are regaining leverage at the negotiating table. It’s still a challenging market for buyers, but affordability is beginning to improve at the margins.

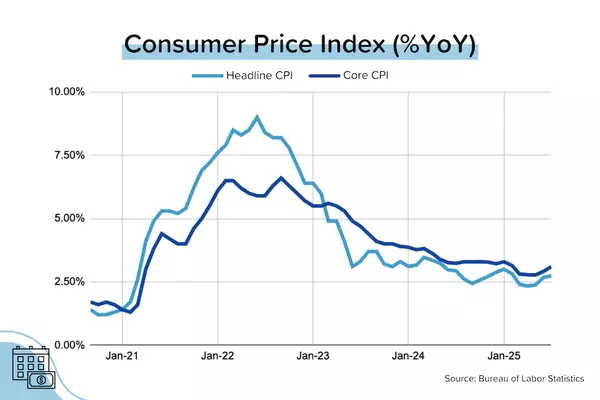

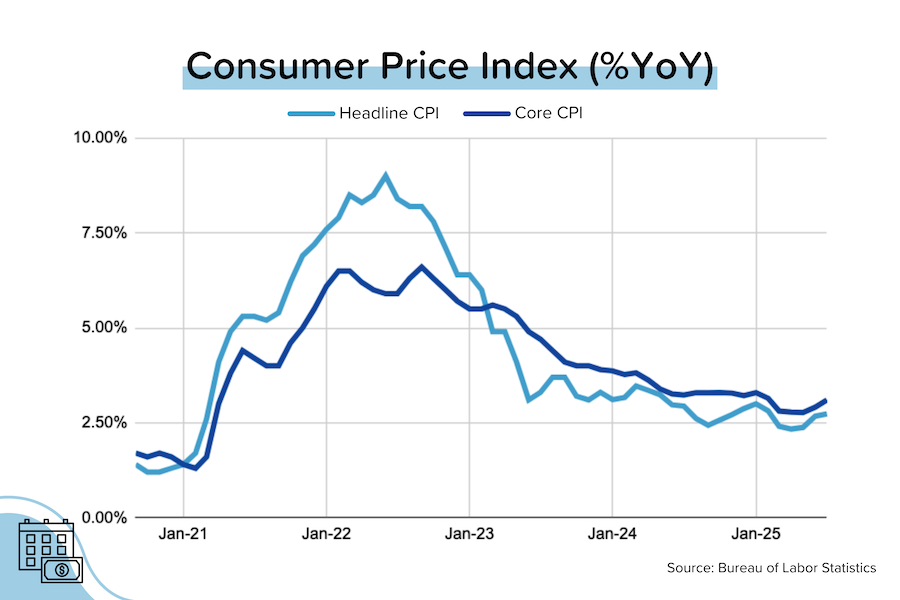

📊 CPI: When “Good Enough” Really Is Good Enough

July’s inflation report landed in that middle ground — not a breakthrough, but steady enough to keep the Fed on course.

-

Headline CPI held flat at +2.7% YoY.

-

Core CPI nudged up to 3.1% YoY (from 2.9% in June).

-

Tariffs showed small effects on items like fresh fruit, coffee, and furniture — but these categories carry tiny weightings in the overall index.

-

Shelter costs (~44% of the core index) slowed slightly to +3.7% YoY.

-

Energy costs (~7% of the headline index) dropped 1.1% month-over-month. [BLS]

👉 Was this a massively encouraging report? No. Core inflation has now risen two months in a row, moving further away from the Fed’s 2% target. But it was “good enough” in two ways: 1) not as bad as feared, and 2) not enough to stop the Fed from cutting rates at its September 17 meeting.

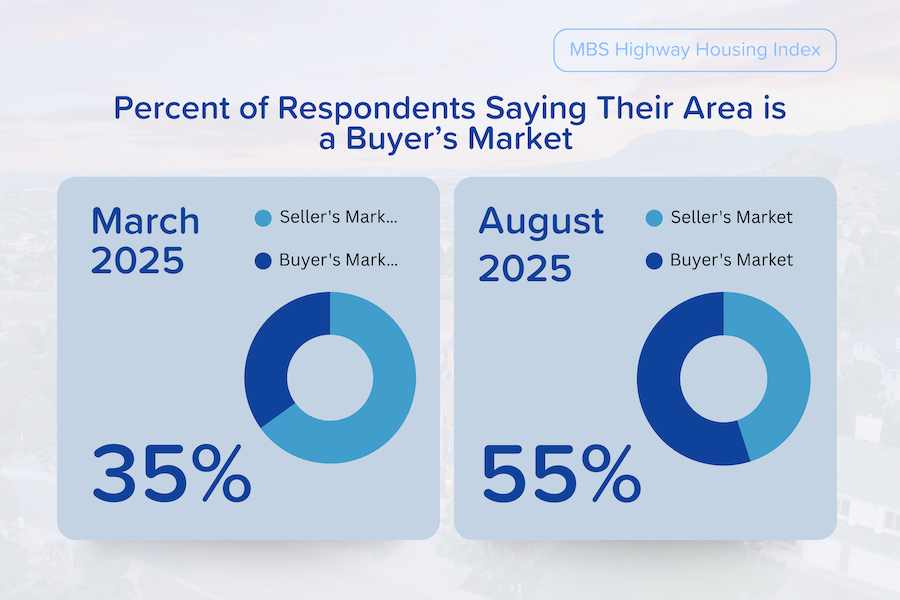

🏠 Housing Sentiment: Buyers Gaining the Upper Hand

The MBS Highway Housing Survey shows continued weakness:

-

The National Housing Index fell another 2 points in August to 24, after an 8-point drop in July.

-

That’s the lowest level since January 2023, when prices were drifting down after the Fed’s rapid tightening cycle. [MBS Highway]

When asked if they were operating in a buyer’s or seller’s market:

-

March 2025: Only 32% said buyer’s market.

-

August 2025: 55% said buyer’s market.

States leading the shift:

-

Florida (83%)

-

Texas (72%)

-

Mississippi (100%)

-

Arizona (91%)

-

Tennessee (87%)

-

Arkansas (80%)

-

Colorado (80%)

-

Oklahoma (75%)

-

Utah (75%)

👉 Translation: buyer’s markets are spreading.

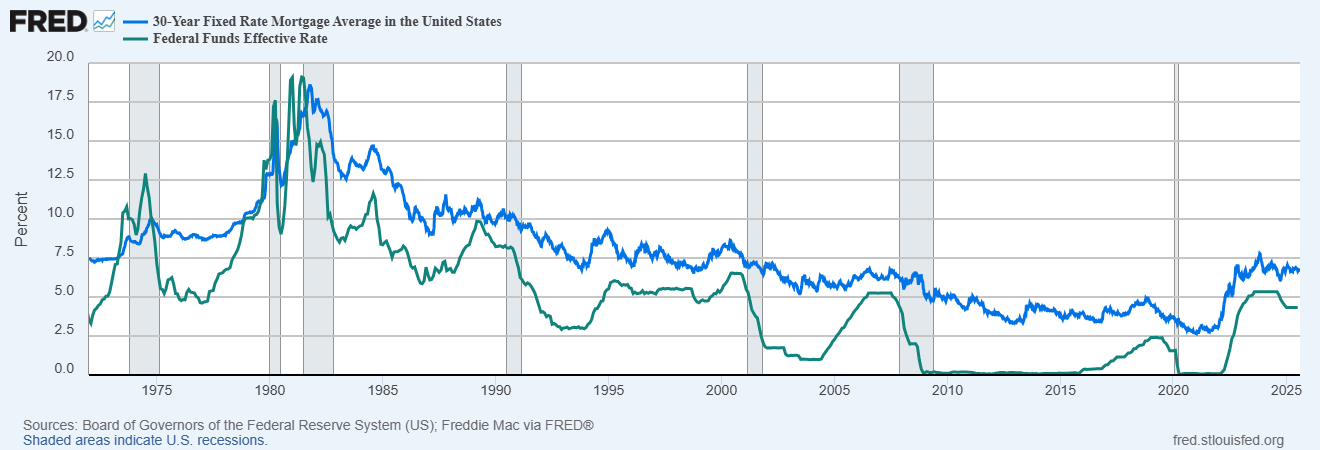

💰 Fed Watch: Bessent Calls for Bigger Cuts

Treasury Secretary Scott Bessent went public, saying the Fed Funds Rate (FFR) is 150–175 bps too high and urging a 50 bps cut in September. The bond market cheered. [Reuters]

Of course, Bessent doesn’t vote, and the Fed is independent. But with Trump confidant Stephen Miran newly named as Fed Governor (replacing Adriana Kugler), and the Fed Chair role still in play, dovish voices are only getting louder.

👉 If the Fed did cut the FFR by 175 bps from today’s level, it would land around 2.75%. With mortgage spreads holding near 200 bps, that implies 30-year mortgage rates around 4.75%. That kind of move would reignite housing demand in a hurry.

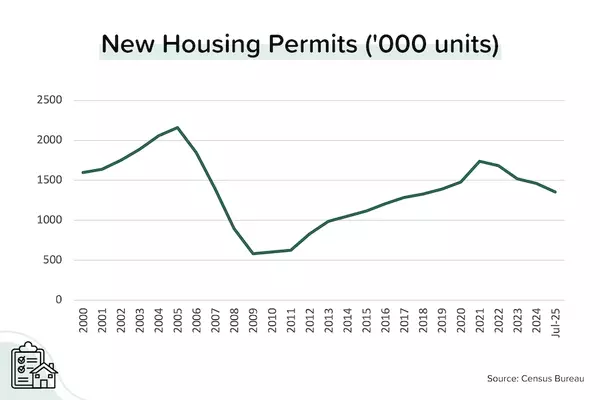

🌊 “Underwater” Mortgages – But This Isn’t 2009

ICE data shows 1% of U.S. home mortgages were underwater (negative equity) at the end of April 2025. In September 2009, that number was 23%.

Local trouble spots include:

-

Cape Coral, FL — 7.8% of mortgages underwater

-

Lakeland, FL — 4.4%

-

San Antonio, TX — 4.3%

-

Austin, TX — 4.2%

Nationwide, though, the impact is limited. [ICE, ResiClub]

📖 Definition: An “underwater” mortgage means the home is worth less than the loan balance. This usually requires prices to fall more than the down payment. Example: With 20% down, prices would need to fall over 20% to hit negative equity.

👉 Why most mortgages are still above water:

-

Home prices haven’t fallen enough, and declines are recent.

-

Owners who’ve held for years have built equity through regular payments.

-

Today’s buffer is bigger than the original down payment.

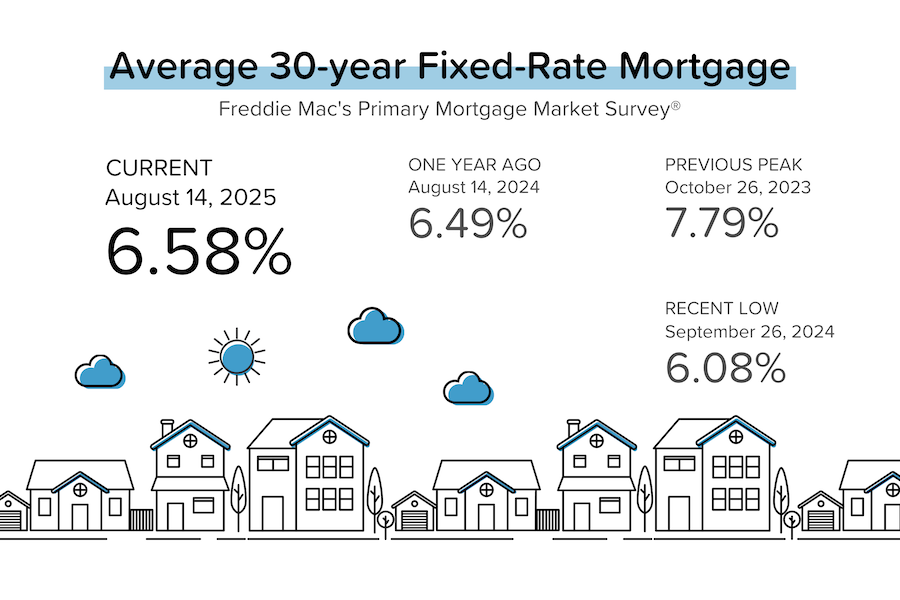

📉 Mortgage Rates Near Breakthrough Levels

Freddie Mac’s weekly survey shows the average 30-year fixed at 6.58%. Refi activity jumped immediately, but purchase activity lags — buyers want proof that rates will stay low before jumping back in. [Freddie Mac]

Reminder: The Fed doesn’t set mortgage rates directly. The Fed sets the overnight bank-to-bank lending rate (the FFR), and mortgage rates are influenced through Treasury bonds and mortgage-backed securities.

-

The correlation isn’t 1:1 in the short term.

-

But over time, mortgage rates follow the Fed’s moves closely.

-

When the Fed cuts aggressively, history shows we’re usually already in recession.

👉 Market rates (like Treasury yields) tend to move ahead of the Fed. That’s why mortgage rates are already sliding — the market is pricing in cuts that haven’t even happened yet.

📈 Bonds, Mortgages & Market Expectations

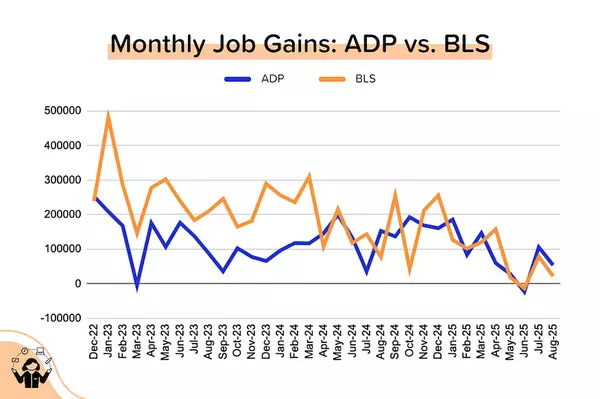

The weak July jobs report (just 73K jobs added, plus downward revisions to May/June) kicked off the latest drop in mortgage rates. Expectations for Fed cuts shifted from 1–2 to 2–3 this year.

Then came CPI — not great, but not an obstacle either.

Then Bessent’s comments — calling for a 50 bps cut in September and 100–125 bps more after.

Here’s what the Fed Funds futures market is pricing in now (current FFR = 4.25–4.50%):

-

September 17 Meeting: 94% chance of -25 bps; 6% chance of -50 bps.

-

October 29 Meeting: 63% chance of -50 bps; 4% chance of -75 bps.

-

December 10 Meeting: 53% chance of -75 bps; 3% chance of -100 bps.

🗣️ They Said It

“I think we could go into a series of rate cuts here, starting with a 50 basis-point rate cut in September. If you look at any model, it suggests that [the Fed Funds Rate] should probably be 150, 175 basis points lower [than it is today].” — Scott Bessent, U.S. Treasury Secretary

“Fifty [basis points] sounds, to me, like we see an urgent [need to cut] — I’m worried it would send off an urgency signal that I don’t feel given the strength of the labor market. I just don’t see that. I don’t see the need to catch up.” — Mary Daly, San Francisco Fed President

© 2025 Joe Johnbosco Team. All rights reserved.

Categories

Recent Posts