Weekend Market Talking Points – August 22, 2025

Prepared by Joe Johnbosco Team

Mortgage Rates & Fed Outlook

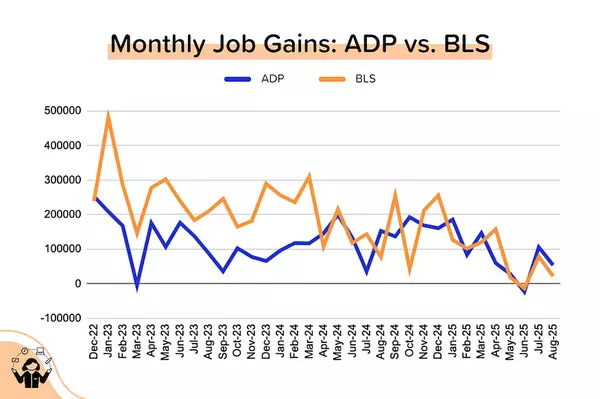

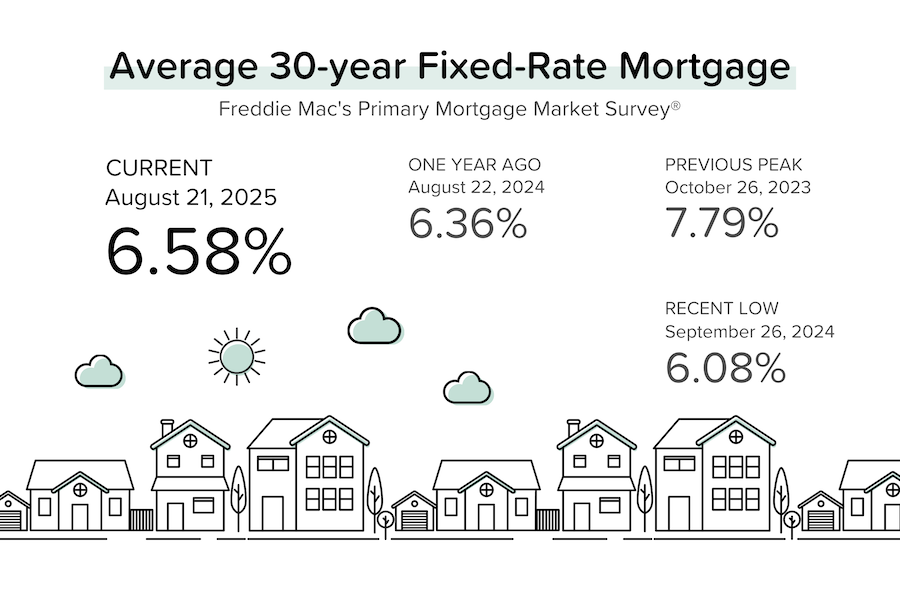

Mortgage rates edged higher this week on renewed concerns that the Fed may not cut rates at its September 17th meeting. While home price growth has been moderating, existing home sales remain flat at about 4 million annually.

The Fed’s July 31 meeting minutes revealed a decidedly hawkish tone. Most members expressed greater concern about inflation than the labor market. Adding to the uncertainty, Kansas City Fed President Jeffrey Schmid delivered more hawkish remarks today. All of this has fueled speculation that Chair Jerome Powell may not signal a September rate cut in his Jackson Hole speech this Friday.

👉 Key Point: Odds of a September rate cut have dropped sharply, sliding from 94% two weeks ago to just 73% today (CME FedWatch, federalreserve.gov).

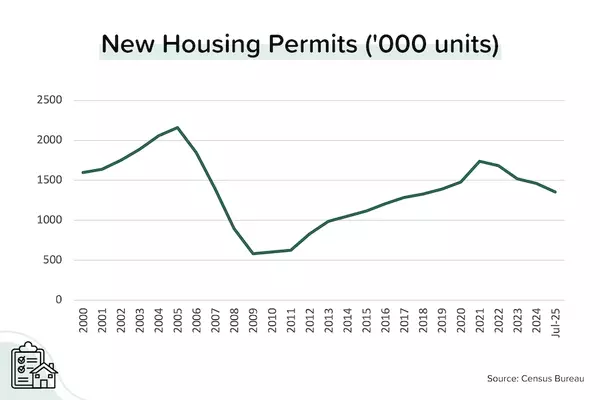

Builder Sentiment & Housing Starts

Builder confidence continues to erode. The NAHB index slipped to 32 in August — a very weak reading compared to levels above 80 during the pandemic construction boom (Sept. 2020–March 2022). Affordability concerns, tariffs, regulatory costs, and rising vacancies are pressuring builders (nahb.org).

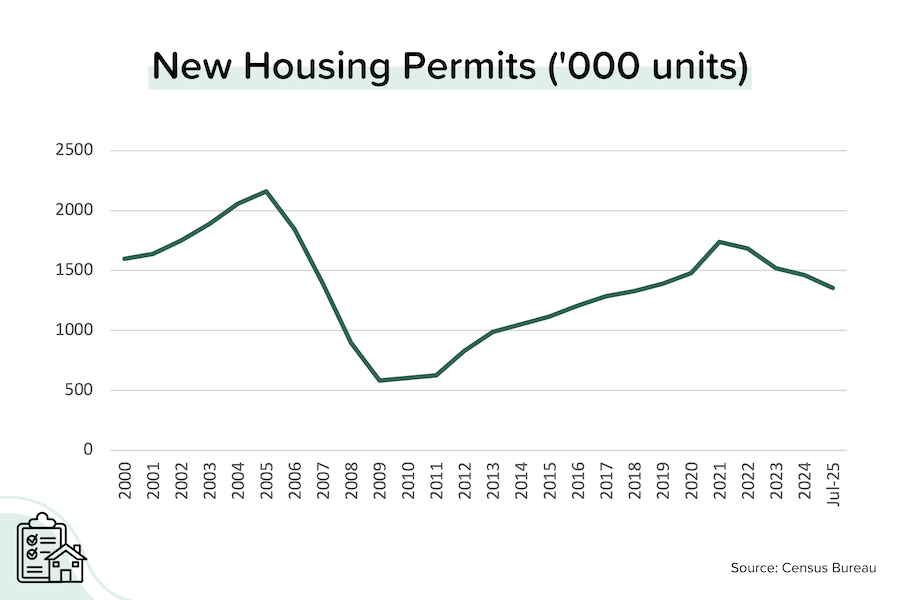

July housing data offered mixed results.

-

Permits: Down 4% YoY, annualized pace of 1.35M units (64% single-family).

-

Starts: Up 8% YoY, with gains concentrated in multifamily (>5 units). (census.gov)

👉 Key Point: Builders are pulling back on large multifamily projects, single-family production remains capped near 1M units annually, and the U.S. still faces a 2–4M unit housing shortage.

Rents & Affordability

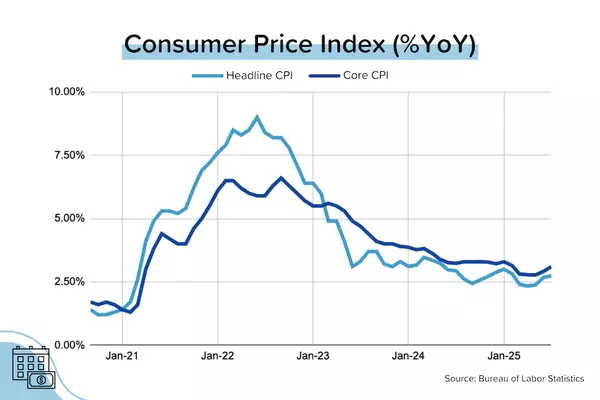

Zillow reports national rent growth slowed to +2.6% YoY in July, down from +2.9% in June. By comparison, the BLS rental index rose +3.5% and owner’s equivalent rent rose +4.1% (zillow.com).

Why it matters: Housing-related categories represent ~41% of “core” CPI. If CPI reflected real-time rental data, inflation would be running closer to +2.6% YoY instead of the reported +3.1%.

👉 Regional Note: 56% of new home completions are in the South, where rental demand is softening. Rates are flat in Dallas, Las Vegas, and Orlando; and falling in Phoenix, San Antonio, Denver, and Dallas.

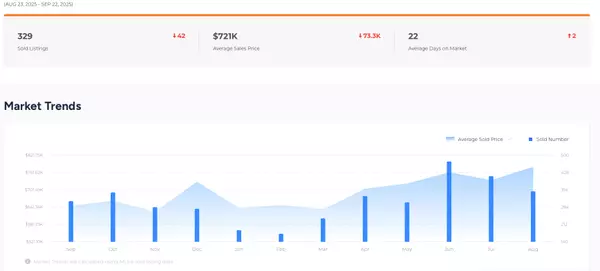

Home Prices

Redfin’s index shows prices declined in 39 of the top 50 metros in July. Nationally, prices slipped -0.1% MoM — a third straight monthly decline, though still up ~2% YoY (redfin.com).

👉 Key Point: The split is regional.

-

South & Mountain regions: Prices falling, inventory above pre-pandemic levels, heavy new construction.

-

Northeast & Midwest: Prices rising, inventory tighter.

We’ll get further confirmation when the Case-Shiller index is released next week.

Bonds & Mortgage Market

Markets still expect a 25 bps cut in September, but confidence has weakened as wholesale inflation (PPI) shows signs of acceleration.

The silver lining: 30-year mortgage rates remain near 6.5%, partly because the spread between mortgage rates and U.S. bond yields has narrowed — a positive for borrowers. Our Home Report is already seeing increased refinance inquiries.

Here’s where probabilities stand for Fed cuts (CME FedWatch):

-

Sept 17 Meeting: 73% chance of -25 bps (down from 94%).

-

Oct 29 Meeting: 51% chance of -25 bps; 34% chance of -50 bps.

-

Dec 10 Meeting: 47% chance of -50 bps; 25% chance of -75 bps.

(Current Fed Funds Rate: 4.25–4.50%)

Voices from the Market

-

“Housing affordability is central to the outlook for economic growth and inflation. Lowering financing costs for construction would ease supply pressures and support mortgage rates.” — Robert Dietz, NAHB Chief Economist

-

“That last mile to 2% inflation is pretty hard. We have to be careful about cutting rates too soon and reigniting inflation expectations.” — Jeffrey Schmid, Kansas City Fed President

✅ Takeaway for Sellers & Buyers: The housing market is caught between slowing prices and limited supply. Mortgage rates remain stable near 6.5%, and while affordability challenges persist, conditions may shift quickly if the Fed signals cuts later this year.

🔎 SEO Meta Information

-

Meta Title: U.S. Housing Market Update – Fed Uncertainty, Slowing Prices & Rent Trends (August 2025)

-

Meta Keywords: U.S. housing market August 2025, mortgage rates update, Fed rate cut odds, builder confidence, housing starts July 2025, rent growth slowdown, Redfin home prices July 2025

-

Meta Description: Mortgage rates hover near 6.5% as Fed rate cut odds slip. Builder sentiment hits new lows, rent growth slows, and home prices decline in 39 of the top 50 metros. Full U.S. housing market update for August 2025.

Categories

Recent Posts