Weekend Talking Points — “Rates Blinked First.” - September 12, 2025

Joe Johnbosco Team | LPT Realty — September 12, 2025

Executive snapshot (for the D-style “just give me the bottom line”)

-

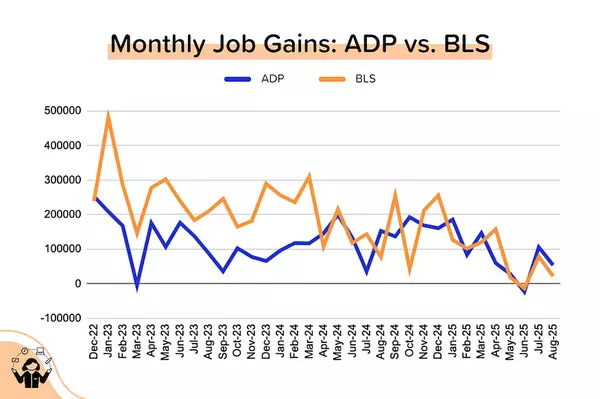

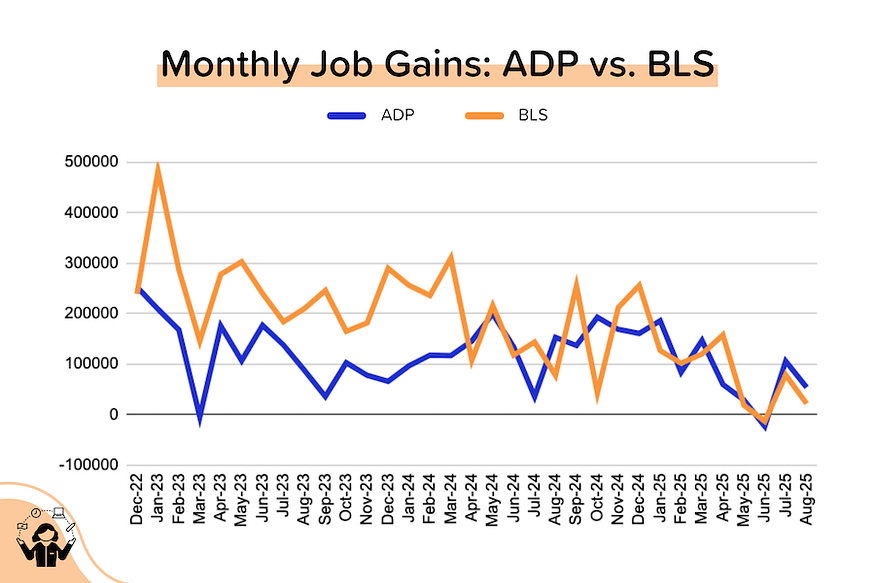

Jobs softened hard: August payrolls +22K, U-3 4.3%, U-6 8.1%; June revised negative — first monthly jobs decline in 4+ years. Bureau of Labor Statistics+1

-

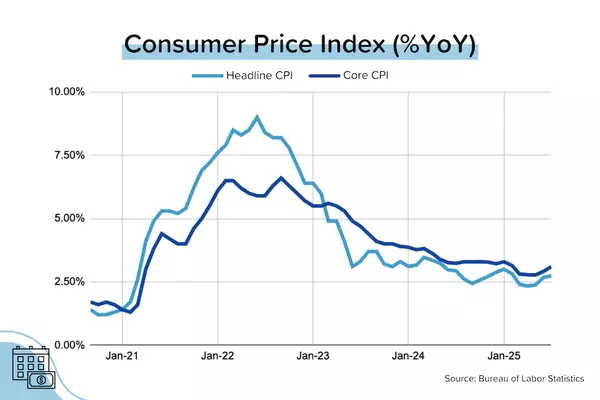

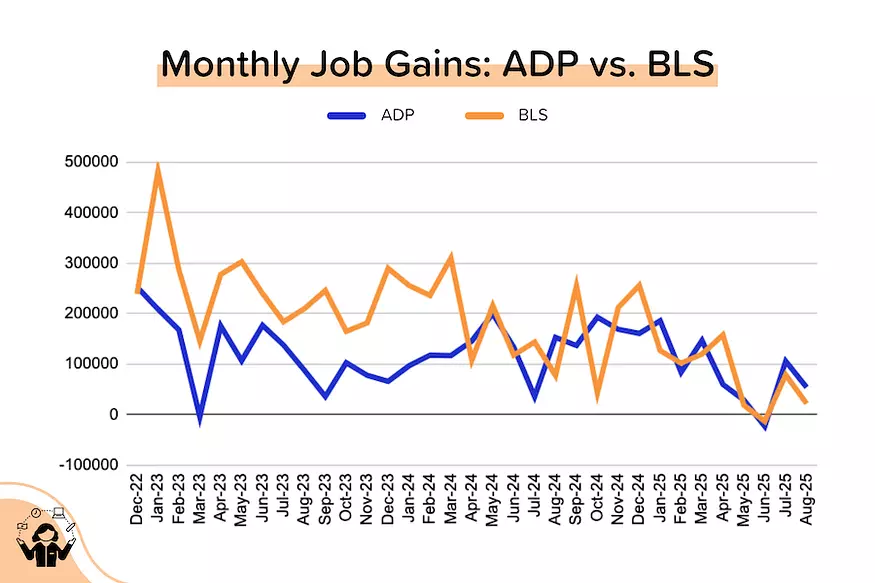

Markets priced in cuts: 10-year Treasury briefly sub-4%; 30-yr mortgage ~6.35% this week. The market moved before the Fed meeting. The Wall Street Journal+1

-

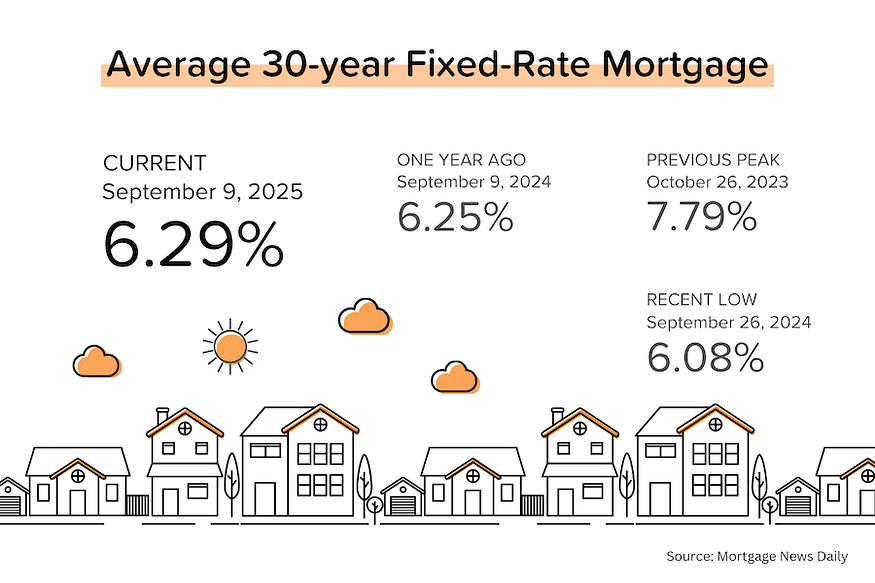

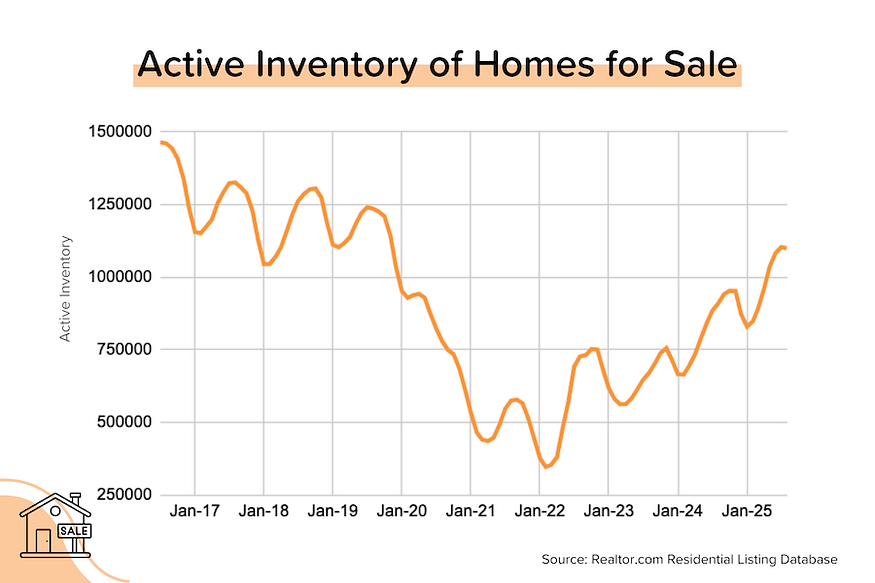

Inventory recovery cooled: U.S. active listings ~1.1M (+20.9% YoY) but still ~11–14% below 2019; Northeast remains tight. Realtor

-

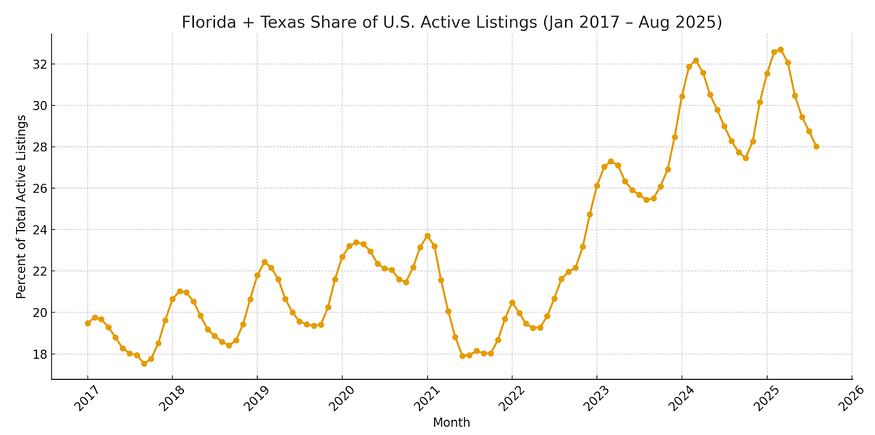

State split: FL/TX above pre-pandemic inventory; PA/NY still 40–45% below 2019. ResiClub+1

-

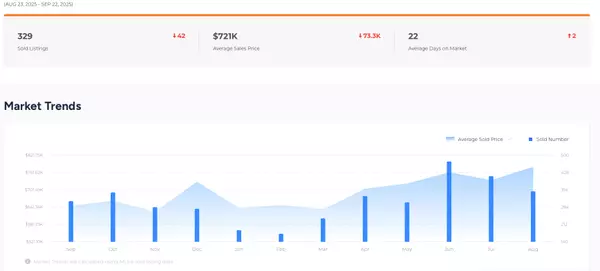

Local (Bright MLS): Mid-Atlantic Days on Market ~15, Philly area showing early softening—more negotiating room than this spring. markets.businessinsider.com

1) Labor Market: the signal, not the noise

What happened: The August BLS report was weak across the board: payrolls +22,000, U-3 ticked to 4.3%, and U-6 underemployment to 8.1%. June was revised to -13,000, breaking a 4-year run of positive monthly gains. Bureau of Labor Statistics+1

Why it matters for real estate: Softer jobs → lower bond yields → lower mortgage rates. The market now expects multiple cuts into year-end; you don’t have to “wait for the Fed” to see rate relief at the street level. Reuters

TP: “This jobs print wasn’t mixed—signals of cooling were everywhere. That’s exactly why borrowing costs eased and why timing a fall move just got more attractive.”

Bonus context: BLS’ QCEW benchmark showed -911,000 vs prior estimates (largest preliminary revision on record), reinforcing the slowdown narrative.

Barry Habib put it plainly: “largest QCEW revision on record.” highway.ai

2) Rates: the market moved before the Fed

-

10-yr Treasury briefly dipped below 4% this week as traders priced in easier policy. The Wall Street Journal

-

30-yr fixed mortgage averaged ~6.35% (Freddie Mac, week ending Sept 11). That’s an 11-month low and a notable affordability boost vs midsummer. Freddie Mac+1

-

Fed expectations: CME FedWatch shows high odds of a Sept 25 bp cut and room for 2–3 cuts by December; current policy 4.25–4.50%. CME Group+2Federal Reserve+2

TP: “Don’t wait for the announcement. Markets front-run policy. If your goal is to refinance, trade up, or right-size, the window is opening now.”

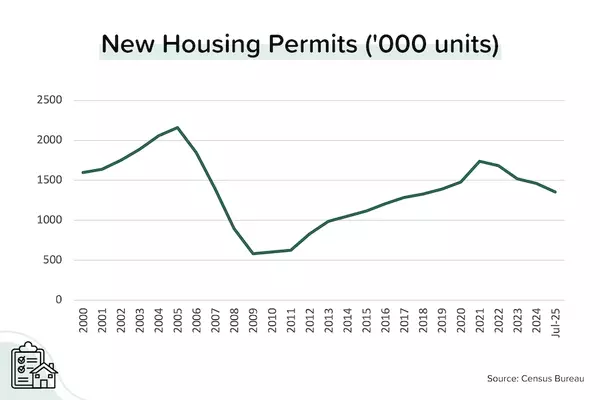

3) Inventory: cooler nationwide recovery; Northeast still tight

-

U.S. active inventory ~1.1M in August (+20.9% YoY), but still ~11–14% below 2019. Growth is decelerating(from +31.5% YoY in May). Realtor

-

Regional split: South/West are amply supplied; Northeast/Midwest remain tighter. Several Sun Belt & Mountain states are back above pre-pandemic inventory. Realtor+1

-

PA & NY: Still ~40–45% below 2019 listings—translation: clean, well-priced homes here remain competitive. highway.ai

Local lens (Bright MLS | Mid-Atlantic & Philly):

-

Median DOM ~15 days; buyers have more negotiating room than in spring, but desirable listings still move fast. markets.businessinsider.com

TP: “Supply is improving, not surging—especially in PA. Good homes still sell quickly if they launch sharp on price and presentation.”

4) Pricing: gentle give in many big metros

Realtor.com notes that more than half of the 100 largest metros posted YoY listing-price declines in August (generally modest). Several high-flyer markets (e.g., Austin, Cape Coral, Honolulu, LA) are seeing larger adjustments as inventory normalizes. Realtor+1

TP: “The story isn’t crashes—it’s normalization. In our market, price strategy and day-one presentation still decide your outcome.”

What this means for you (DISC-tuned guidance)

-

Dominance (D): Act on rate dips. If a fall move is on your radar, we can lock a rate and launch in 11 days to capture buyer demand before any winter slowdown.

-

Influence (I): Momentum is back. Lower payments are bringing sidelined buyers out. Let’s refresh your marketing—gorgeous media + retargeted ads = faster traction.

-

Steadiness (S): We’ll handle the steps. Pre-list tune-up, pricing model, and our 2-week prep checklist keep it calm and predictable.

-

Compliance (C): Numbers first. I’ll share a MLS-sourced CMA, absorption, and list-to-sale spread so your decision is fully defended by data.

Joe’s Action Plan (seller & move-up buyer)

-

Pre-approval refresh at today’s lower rates; model payment bands at 6.0–6.75%.

-

11-Day Launch-to-Sold: pro media, neighborhood packaging, and real-time feedback to maximize first-week absorption.

-

If you’re buying & selling, we’ll sequence: list-prep → buy-side rate/term options → synchronized close.

CTA: Reply “11DAY” for the 1-page roadmap & prep checklist; I’ll pencil your preferred launch week.

Sources (plain URLs)

-

BLS Employment Situation (Aug 2025): https://www.bls.gov/news.release/empsit.htm and PDF: https://www.bls.gov/news.release/pdf/empsit.pdf

-

BLS Table A-15 (U-6): https://www.bls.gov/news.release/empsit.t15.htm

-

Preliminary benchmark/QCEW revision: https://www.bls.gov/web/empsit/cesprelbmk.htm

-

CME FedWatch (probabilities): https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html

-

Federal funds range & minutes: https://www.federalreserve.gov/monetarypolicy/fomcminutes20250730.htm

-

10-yr Treasury sub-4% (news coverage): https://www.wsj.com/livecoverage/cpi-report-today-inflation-stock-market-09-11-2025

-

Freddie Mac PMMS (weekly mortgage rates): https://www.freddiemac.com/pmms and news: https://freddiemac.gcs-web.com/news-releases/news-release-details/mortgage-rates-drop-8

-

Realtor.com Monthly Trends (Aug 2025): https://www.realtor.com/research/august-2025-data-2/

-

Bright MLS Market Reports: https://brightmls.com/article/monthly-market-report

-

Highway.ai (compiled analytics & quotes): https://www.highway.ai/blog/weekend-talking-points-september-12-2025

Citations

Key figures and claims above are supported by: BLS labor report & tables (jobs +22K; U-3 4.3%; U-6 8.1%), Freddie Mac PMMS (30-yr at ~6.35%), CME FedWatch (cut odds), WSJ (10-yr dipped sub-4%), Realtor.com (inventory trend), Bright MLS (Mid-Atlantic DOM), and Highway.ai (state-level inventory compilation and Habib quote). highway.ai+7Bureau of Labor Statistics+7Bureau of Labor Statistics+7

Categories

Recent Posts