The Home Loan Process Explained: Step-by-Step from Application to Closing

Buying a home is one of the most significant financial decisions you’ll ever make, and unless you’re paying cash, securing a mortgage will be central to your purchase. Understanding the home loan process can empower you to move through it confidently and efficiently—avoiding costly mistakes and delays.

This guide walks you through every step of the mortgage loan process, from application to the final closing table, with added tips and insights to help you feel informed and prepared.

🔟 Steps to Securing Your Home Loan

Step 1: The Application — Setting the Foundation

The mortgage process begins with a detailed application, often referred to as the Uniform Residential Loan Application (URLA or Form 1003). Your lender collects personal financial information such as income, employment history, assets, debts, and credit details.

✅ Pro Tip: The smoother this step goes, the faster the entire process can move. Gather tax returns, pay stubs, W-2s, and bank statements beforehand.

Why it matters for all personalities:

-

Dominance: Helps you stay in control of your deal.

-

Influence: Sets the tone for positive communication.

-

Steadiness: Creates a clear, organized start.

-

Compliance: Satisfies attention to detail and documentation.

Step 2: Automated Underwriting – Fast Track Decisioning

Once the application is submitted, the lender runs it through an Automated Underwriting System (AUS) such as Fannie Mae’s DU or Freddie Mac’s LPA.

This step uses algorithms to evaluate:

-

Credit score and history

-

Debt-to-income (DTI) ratio

-

Property value

-

Loan-to-value (LTV) ratio

🧠 Stat Insight: According to the CFPB, the average DTI ratio for approved conventional loans in 2023 was 36%(www.consumerfinance.gov).

Step 3: Documentation Requests

After the AUS provides a preliminary decision (often “approve/eligible” or “refer”), the lender will request supporting documents such as:

-

Two years of W-2s and tax returns

-

Recent pay stubs

-

2-3 months of bank statements

-

Verification of employment and assets

-

Gift letters, if applicable

🔍 These documents help verify the information in your application and satisfy underwriting requirements.

Step 4: You Go Under Contract on a Home

With pre-approval in hand and documents gathered, you can confidently make an offer on a property. Once accepted, a fully executed purchase agreement is added to your loan file.

Step 5: Loan Submission

The loan officer compiles a complete loan package including:

-

Purchase contract

-

Property appraisal order

-

Preliminary title report

-

Borrower documents

-

Any conditions from the AUS

This package is then submitted to the underwriting department for review and final approval.

Step 6: Underwriting & Loan Approval

The underwriter evaluates all documents for compliance with lending guidelines. They review:

-

Appraisal to confirm market value

-

Title report for liens or encumbrances

-

Income and assets for consistency

📌 Note: The underwriter may issue a conditional approval, requiring a few final documents.

Step 7: Rate Lock & Final Loan Program Selection

Based on market trends and your loan approval, you’ll discuss whether to lock in your interest rate or float it.

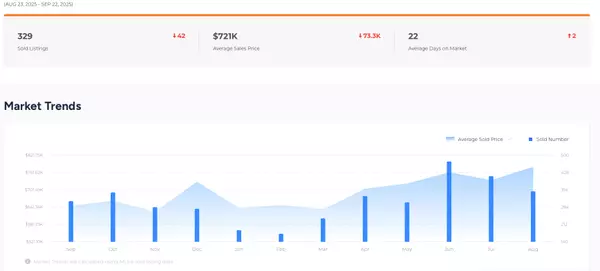

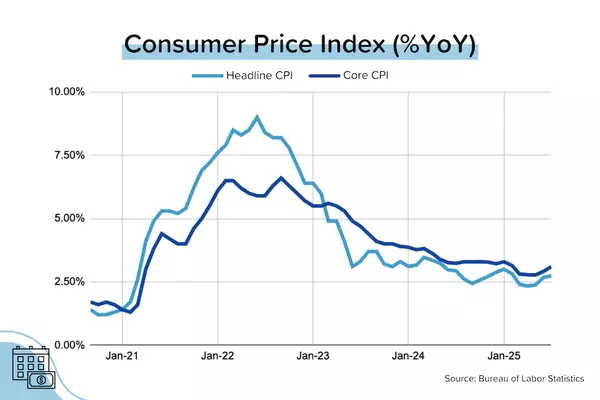

💡 According to Mortgage News Daily, average 30-year fixed mortgage rates in April 2025 hover around 6.75% (www.mortgagenewsdaily.com).

You’ll also finalize:

-

Loan type (Conventional, FHA, VA, etc.)

-

Fixed vs. adjustable rate

-

Term (15, 20, or 30 years)

Step 8: Loan Documents Are Drawn

Once the loan is approved and the interest rate is locked, the lender prepares the closing disclosure (CD) and loan documents, which include:

-

Promissory Note

-

Deed of Trust or Mortgage

-

Final loan terms and costs

You’ll sign these documents at the escrow or title office, and you’ll be notified of your exact cash-to-close amount.

Step 9: Loan Funding

After you sign, the lender conducts a final review of the executed documents. Once confirmed:

-

The lender wires the funds to the title company

-

You provide your closing funds via wire or cashier’s check

-

Any remaining conditions are cleared

🛑 Important: Personal checks are not accepted. Use only verified wire transfers or certified checks.

Step 10: Recordation & Closing

Once funds are received, the title company records the deed and deed of trust at the local county recorder’s office, making the transaction official and public.

🎉 Congratulations — you are now a homeowner!

Final Thoughts

Understanding the home loan process equips you to take proactive steps, ask better questions, and align with the right lender and real estate agent. Whether you’re driven by results, motivated by connection, prefer stability, or rely on precision, this process can meet your needs with the right guidance.

For more tips on financing and real estate in your area, reach out to a local expert (like me!) who can walk you through the nuances that matter most in your market.

📈 Sources:

Categories

Recent Posts