Understanding and Evaluating Purchase Offers on Your Home

When selling your home, receiving an offer is an exciting milestone. However, it can also come with a wave of questions, decisions, and emotions. Understanding how purchase offers work—and how to evaluate them—can make a huge difference in your experience and financial outcome.

As your real estate partner, I’ll walk with you through each step, ensuring you have the knowledge and guidance to make confident decisions.

What Is an Offer?

A purchase offer is typically presented as a formal, written contract from a prospective buyer, usually through their real estate agent. The offer outlines essential terms including:

-

Offer price

-

Contingencies (such as financing, appraisal, or home inspection)

-

Closing date

-

Earnest money deposit

-

Inclusions/exclusions (e.g., appliances or fixtures)

All offers will be presented to me as your listing agent, and I’ll promptly bring them to you for review. If multiple offers are received, they’ll be presented together so we can compare them side by side.

How Quickly Do I Need to Respond?

In real estate, time is of the essence. Most offers come with strict expiration dates, often requiring a response within 24 to 72 hours. Quick but thoughtful decision-making is crucial to keep the transaction moving and prevent the buyer from withdrawing.

Throughout the negotiation process, I’ll be in constant communication, helping you understand your options and next steps.

Are Offer Terms Confidential?

Yes. The details of any offer are confidential and known only to you and me until you’ve accepted the offer. You’ll be kept updated on the level of interest from other buyers, but specific terms of competing offers are never disclosed without permission.

Evaluating an Offer: More Than Just the Price

While price is important, there are many variables that influence the strength and appeal of an offer. My role is to help you assess the full picture so you don’t leave money—or peace of mind—on the table.

Here’s how I assist in evaluating every offer you receive:

1. Analyze Buyer Qualifications

We’ll gather and review the buyer’s background, including pre-approval status, financing method (cash vs. loan), and their intent (primary residence, rental, etc.).

2. Review the Contract Thoroughly

I’ll walk you through the entire purchase agreement, ensuring you understand terms like:

-

Contingency periods

-

Repair requests

-

Escrow timeline

-

Occupancy terms

3. Highlight the Market Context

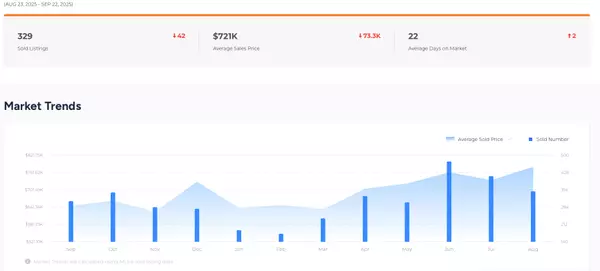

Using recent Comparative Market Analysis (CMA) data, we’ll compare the offer to current listings, pendings, and recent solds in your neighborhood.

4. Negotiate Strategically

I’ll advise you on counteroffer strategies, ways to strengthen your position, and how to structure favorable terms—especially in multiple-offer situations.

5. Navigate Legal & Regulatory Disclosures

We’ll ensure compliance with key local, state, and federal regulations, such as:

-

Transfer Disclosure Statement (TDS)

-

Smoke Detector Compliance

-

Natural Hazard Disclosure (NHD)

-

Lead Paint Disclosure (for homes built before 1978)

-

FIRPTA (Foreign Investment in Real Property Tax Act)

Final Decision: Accept, Reject, or Counter

Ultimately, you decide whether to accept, reject, or counter an offer. I will provide all available information, market insights, and my professional opinion—but your goals and comfort will always come first.

In certain situations, it may also be advisable to consult with a real estate attorney or tax advisor for additional guidance.

Let’s Maximize Your Outcome

Selling your home is both a financial and emotional journey. With the right information and trusted guidance, you can confidently navigate any offer that comes your way. Let’s work together to get you the best possible outcome—on your terms.

✅ Pro Tip:

If you're in a multiple offer situation, don’t automatically jump for the highest price. We’ll consider contingencies, closing speed, and financing type to determine which offer truly benefits you most

Categories

Recent Posts