Your Ultimate Mortgage Loan Application Checklist

Be Prepared. Get Approved Faster. Buy Smarter.

When you're applying for a mortgage, preparation is power. Lenders need to verify your financial health, employment history, and ability to repay the loan—quickly and clearly. Having all your documentation ready upfront can make the process smoother, reduce stress, and even help you close on your dream home faster.

Whether you're a first-time buyer, moving up, or downsizing, this comprehensive loan application checklist will help you stay ahead of the game and increase your chances of a seamless approval.

✅ Real Estate Contracts

Why It Matters: Your purchase agreement provides the lender with critical details about your home purchase—such as price, closing date, contingencies, and terms.

-

📄 Purchase Agreement (if you're buying a home)

-

📄 Sales Contract (if you're selling a home concurrently)

According to the Consumer Financial Protection Bureau, submitting a fully signed purchase agreement is one of the first major steps in mortgage processing. (Source: www.consumerfinance.gov)

🏠 Residence History (Past 2 Years)

Why It Matters: Lenders want to verify your stability and identify any potential red flags.

-

📌 All addresses for the last 24 months

-

📌 Duration of time at each address

-

📌 Landlord contact info (if renting)

Steady residence history reassures lenders of your reliability—especially if you’re transitioning from renting to owning.

💼 Employment & Income Verification

Why It Matters: Verifying your employment helps the lender determine how much you can afford and whether you meet income qualifications.

-

🧾 Pay Stubs (most recent 30 days)

-

🧾 Employer Names & Addresses (last 2 years)

-

🧾 Dates of Employment

-

🧾 W-2s (last 2 years)

-

🧾 Federal Tax Returns (last 2 years with all schedules)

-

✍️ Employment Gaps? Be ready to explain them clearly.

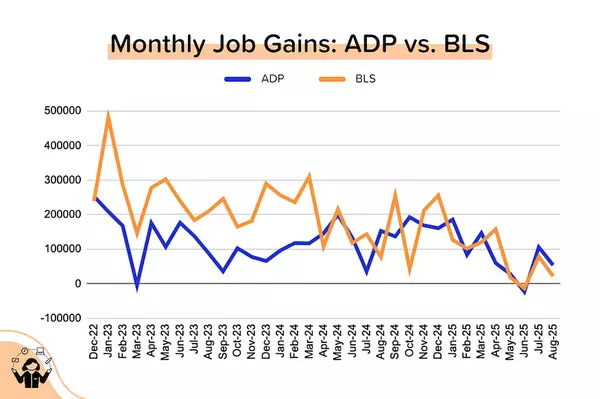

Stable income and employment are top factors in mortgage approvals. The Mortgage Bankers Association notes that changes in employment status are among the leading causes of loan delays. (Source: www.mba.org)

💳 Financial History

Why It Matters: Your debts, assets, and overall financial picture help lenders calculate your debt-to-income ratio (DTI)—a key factor in loan qualification.

-

🧾 Loan & Credit Card Statements (latest monthly statements)

-

🧾 Bank Statements (last 3 months for all accounts)

-

🧾 Brokerage Accounts, IRAs, Pensions

-

🧾 Self-Employed or 1099? Include full tax returns for 2 years + YTD P&L

-

🧾 Own a Business? Provide 2 years of corporate returns + YTD P&L and balance sheet

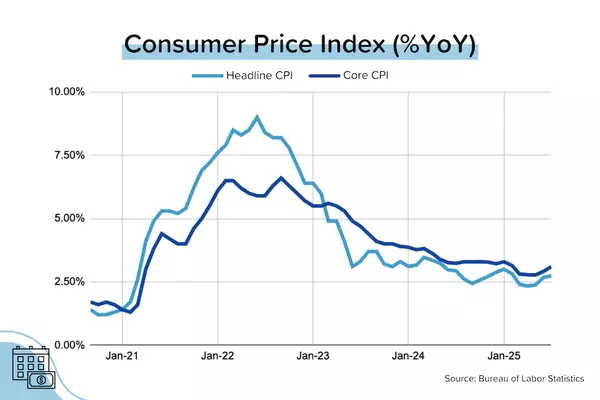

Lenders generally prefer a DTI under 43%, although some programs allow for higher ratios depending on credit and compensating factors. (Source: www.investopedia.com)

🏘️ Current Real Estate Holdings

Why It Matters: Lenders need to factor in your current liabilities and obligations if you already own property.

-

🧾 Property addresses and estimated market values

-

🧾 Monthly mortgage payments + balances (include loan statements)

-

🧾 For rentals: most recent tax returns and active leases

Owning investment property? Make sure to disclose income and expenses accurately. It may strengthen your application if managed properly.

🛋️ Personal Property & Assets

Why It Matters: Additional assets can act as reserves or be liquidated in times of need, strengthening your borrower profile.

-

🧾 Life Insurance (net cash value)

-

🚗 Vehicles (year, make, estimated value)

-

🏡 Furniture & Personal Property (approximate value)

💡 Pro Tip: Digitize Everything

Make scanned copies or PDFs of all documentation so they can be emailed or uploaded easily into your lender’s portal. Keeping a digital backup also protects against lost paperwork and speeds up responses to lender inquiries.

🧭 Final Thoughts

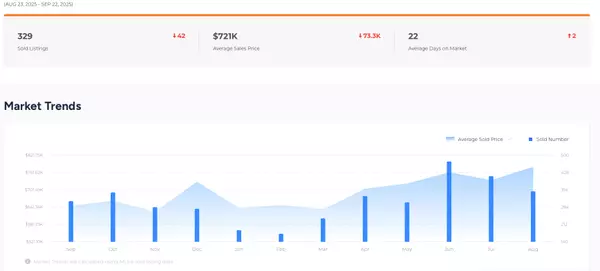

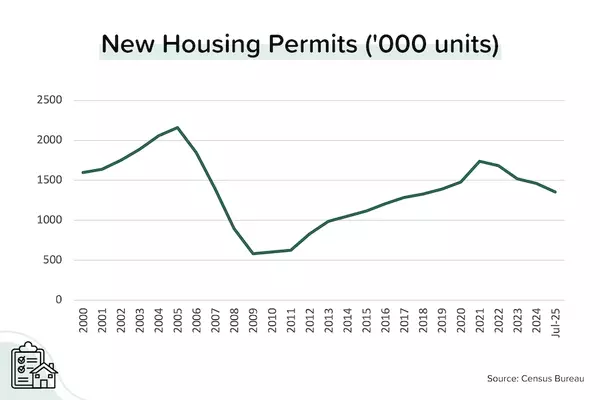

If you're organized, the mortgage process doesn’t have to be intimidating. This checklist serves as your roadmap to mortgage readiness—and it’s one of the best things you can do to avoid delays, surprises, or missed opportunities in a fast-paced housing market.

And if you're not sure where to start, that's where I come in. As a seasoned real estate professional, I not only help clients find homes—they count on me to connect them with reputable lenders, prepare applications, and navigate every step with confidence and clarity.

Categories

Recent Posts