Help Me Understand—Why Are You Still Guessing Your Home’s Worth?

When was the last time you checked the true value of your home? If your answer involves scrolling Zillow or peeking at your neighbor’s listing, it might be time for a reality check. In today's evolving real estate market, "guessing" your home’s value could cost you—big time.

The Problem With Online Estimates

Let’s start with the elephant in the room: online home value estimators. They’re quick, they’re free, and let’s be honest—they’re fun. But they’re not always accurate.

Take Zillow’s Zestimate, for example. According to Zillow itself, the Zestimate has a median error rate of 2.4% for on-market homes and 7.49% for off-market homes (source: www.zillow.com/z/zestimate). That means on a $500,000 home, your "off-market" estimate could be off by nearly $37,500. That’s not small change.

These algorithms don’t walk through your home. They don’t see the recent upgrades, the charming details, or the new roof you just installed. They rely on general data—square footage, lot size, zip code—not nuance or market psychology.

Your Home’s Worth Is More Than Just a Number

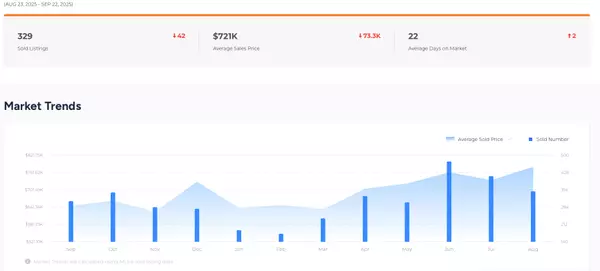

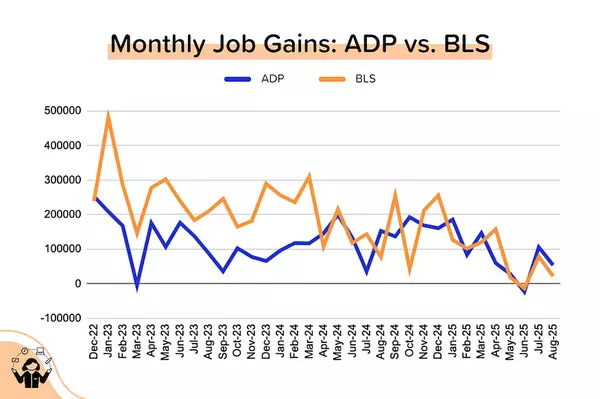

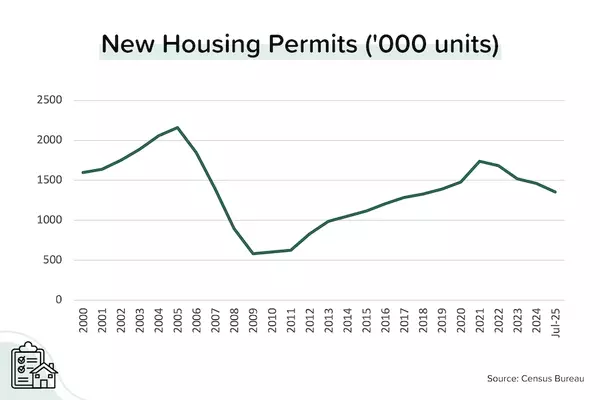

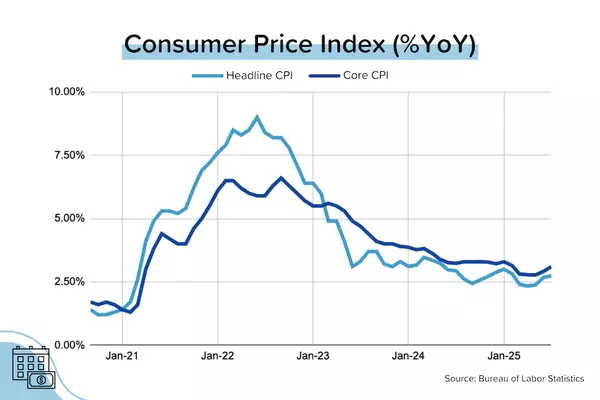

The value of your home is dynamic. It’s affected by hyperlocal trends, current inventory levels, interest rates, buyer demand, school district performance, and even recent renovations or deferred maintenance. Real estate is a living, breathing market—numbers on a screen can’t tell the full story.

For example, if homes in your neighborhood are getting multiple offers over asking, you might be sitting on a hot asset. On the flip side, if buyer demand is waning or your home hasn’t been updated in a decade, the market will reflect that, too.

Only a professional Comparative Market Analysis (CMA) or full appraisal can give you the closest reflection of what today’s buyers are willing to pay. As a real estate expert, I use sold comps, pending listings, current competition, and market momentum to pinpoint your price range—not guesswork.

Here’s Why It Matters—Even If You’re Not Selling Yet

You might think, “I’m not ready to sell, so why does it matter?” But knowing your home’s accurate value helps you make smarter financial decisions:

-

Refinancing? You’ll need a realistic value to determine loan-to-value ratios.

-

Insurance? You may be underinsured (or overpaying) if your home's value is wrong.

-

Tax planning? Your assessed value and equity impact your estate and financial goals.

-

Home improvements? Not every upgrade gives you a good return. Value-based guidance can help.

-

Retirement or downsizing? Equity is a key part of your wealth—know how much you’re working with.

Still Guessing? Let’s Change That.

You wouldn’t guess the value of your car, your business, or your investments—so why gamble on your largest asset?

If you’re even curious about your home's current value, I’d love to offer a free, personalized market analysis. It’s confidential, pressure-free, and tailored to your home—not just your zip code.

📞 Call, 📧 email, or 💬 DM me anytime—let’s stop guessing and start knowing.

Categories

Recent Posts