Comprehensive Guide to Securing a Home Loan

Understanding Mortgages

Unless you're planning to purchase your home with cash—an increasingly rare scenario, accounting for just 26% of home sales in 2023 according to the National Association of Realtors (www.nar.realtor)—you'll likely need to secure a mortgage. While this process can feel daunting, understanding key components can significantly simplify your home buying journey.

A mortgage is essentially a loan secured against your home, which acts as collateral until you repay the loan fully, including the accrued interest. According to Experian (www.experian.com), the average mortgage balance in the U.S. in 2023 was approximately $236,443, highlighting the widespread reliance on mortgage financing.

Key Components of a Mortgage

Principal is the actual loan amount borrowed. For instance, if your loan amount is $300,000, your principal is exactly $300,000.

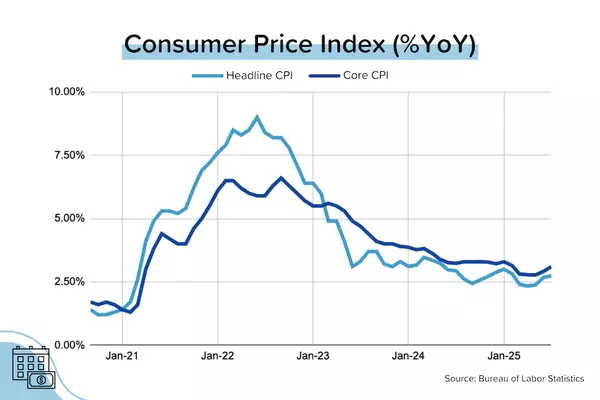

Interest is the cost you pay for borrowing money, influenced by the loan type, interest rate, and market conditions. For example, a difference of just 0.25% in your interest rate can significantly impact your monthly payments and the total interest paid over the loan term. Bankrate.com provides real-time insights into how interest rates fluctuate and impact your loan (www.bankrate.com).

Moreover, mortgage interest is tax-deductible, making homeownership financially advantageous. According to IRS data (www.irs.gov), homeowners saved an average of $3,000 annually through mortgage interest deductions.

What is Mortgage Amortization?

Amortization refers to the schedule of loan repayments, detailing how payments gradually shift from interest-heavy to principal-heavy over the loan duration. During the initial years (typically the first 2-3 years of a 30-year loan), the majority of your payments go toward interest. In the latter part of the loan term, payments primarily cover the principal. Understanding amortization helps you better plan financial strategies and manage expectations.

How to Choose the Right Lender

Selecting the right lender is critical—this decision impacts not just your loan terms but also your home buying experience. Consider these key criteria:

-

Financial Stability: Ensure your lender has a strong financial foundation. Utilize resources such as the Better Business Bureau (www.bbb.org) to check lender ratings and reviews.

-

Customer Service: Opt for lenders renowned for excellent customer satisfaction and responsive communication.

-

Local Processing Capabilities: A lender with local authority to process loans can streamline your application process, making it easier to track your application's progress and resolve queries quickly.

Consult with your real estate agent, friends, or family members for recommendations and read online reviews and ratings. According to J.D. Power’s 2023 U.S. Mortgage Origination Satisfaction Study (www.jdpower.com), lenders with high customer satisfaction scores significantly reduce borrower stress during the mortgage process.

Comparing Loan Terms

When comparing mortgage offers, it's important to evaluate beyond just the interest rate. Speak with multiple lenders via phone, in-person, or conduct comprehensive online searches. Key comparison points include:

-

Loan Types: Fixed-rate vs. adjustable-rate mortgages (ARMs), FHA, VA, or conventional loans.

-

Closing Costs: These can significantly differ between lenders.

-

Loan Processing Time: Efficient lenders can expedite your home buying process.

A reliable real estate agent can assist by recommending trusted lenders and explaining nuanced differences between various mortgage options.

Importance of Interest Rates

While interest rates are crucial, especially at the moment you lock in your rate, it's essential to choose a mortgage program that aligns well with your overall financial situation. According to Freddie Mac (www.freddiemac.com), the historical average for 30-year fixed-rate mortgages was around 7.31% as of early 2024. Small variations, even as little as 0.25%, can affect monthly payments, but focusing excessively on minor rate fluctuations can lead to overlooking important aspects like customer service and lender reliability.

By carefully evaluating these elements, you'll be better prepared to secure a mortgage that aligns with your financial goals and homeownership aspirations.

Categories

Recent Posts