Weekend Talking Points - 'Overstated' - 12/15/2025

The Fed’s latest move: why it matters for home buyers and sellers

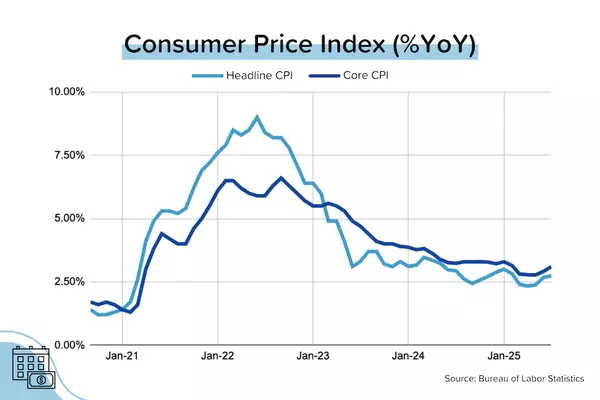

If you’ve been watching mortgage rates like it’s a live sports score, you’re not alone. This week, the Federal Reserve made three headline-worthy moves that can influence the direction of borrowing costs:

-

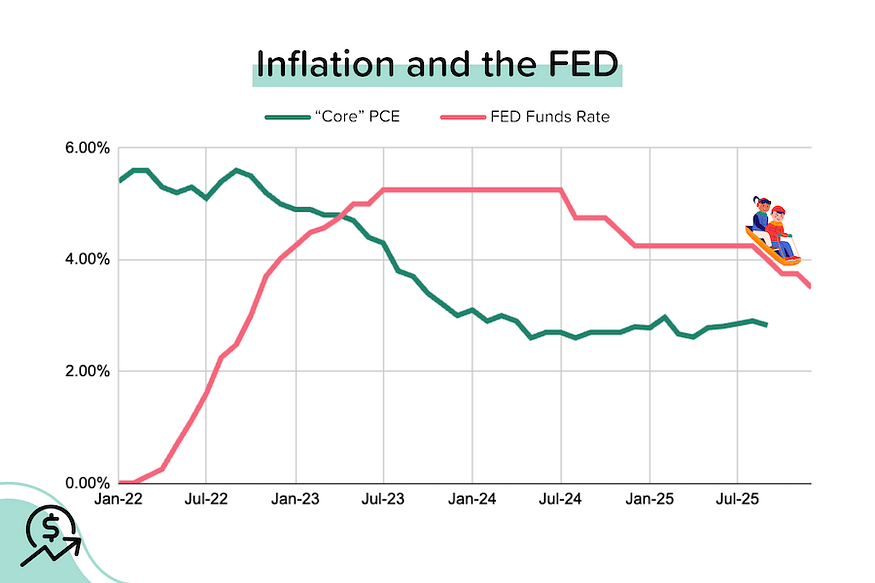

The Fed cut its benchmark short-term rate again, marking the third cut of 2025.

-

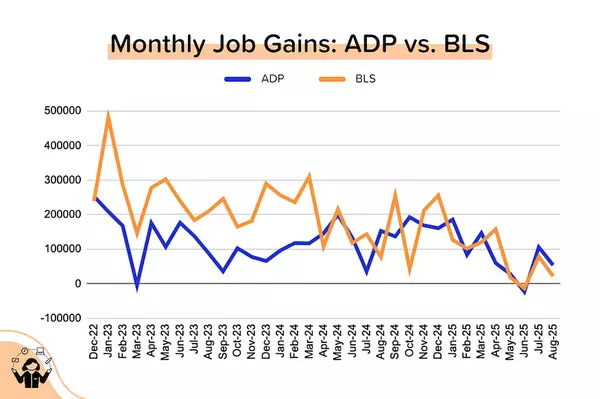

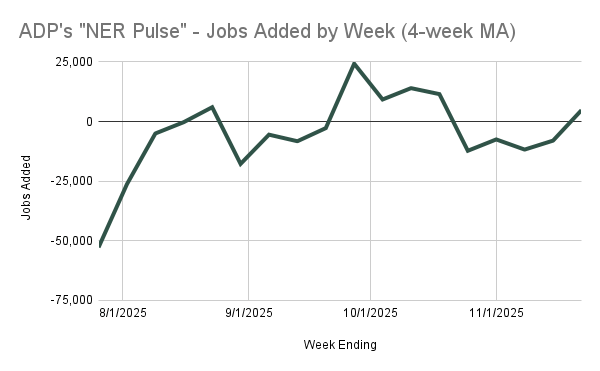

Fed leadership flagged that recent BLS jobs numbers may be overstating job growth, which changes how markets read the strength of the economy.

-

The Fed announced it will initiate purchases of shorter-term Treasury securities to help maintain an ample level of reserves and keep short-term funding markets stable.

So… does that mean mortgage rates drop tomorrow? Not exactly. But it can shape the trend.

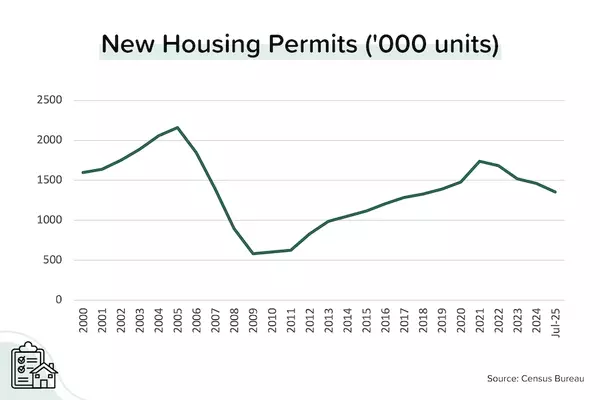

Mortgage rates don’t follow the Fed… they follow the market

Mortgage rates are influenced most directly by the bond market—especially longer-term Treasury yields and mortgage-backed securities (MBS). When investors expect slower growth or a cooler job market, yields often fall. And when yields fall, mortgage rates can sometimes follow.

A Fed rate cut can reinforce that “lower-yield” narrative. Add in softer confidence around jobs data, and the market may price in more caution—again, potentially supportive for lower yields.

What are “short-term Treasury purchases,” and why should you care?

When you hear “asset purchases,” it’s easy to think “QE.” But what the Fed is describing here is commonly framed as reserve management—a technical tool to keep enough liquidity (reserves) in the system so short-term rates behave the way the Fed intends.

Even when it’s “technical,” purchases can still be meaningful to markets because they can:

-

Reduce stress in short-term funding markets

-

Improve liquidity conditions

-

Support steadier bond pricing (which can help rate volatility calm down)

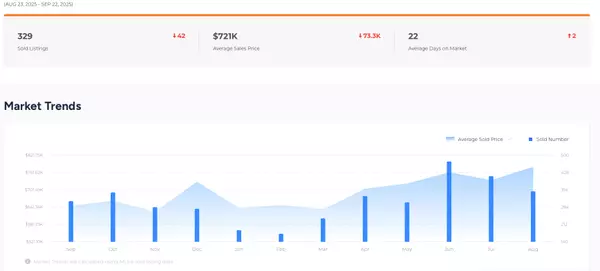

What this could mean for Philly Metro buyers

If mortgage rates trend even modestly lower, it can change the math for buyers in a big way:

-

A slightly lower rate can reduce monthly payments

-

Improved affordability can expand what you qualify for

-

Buyer confidence often rises when rate swings calm down

Smart buyer move right now: get fully pre-approved (not just pre-qualified) and ask your lender about rate lock options(30/45/60 days), especially if you’re actively shopping.

What this could mean for Philly Metro sellers

When rates stabilize or soften, two things tend to happen:

-

More buyers re-enter the market

-

Showings and offer activity can improve—especially for well-priced homes in desirable neighborhoods

That said, sellers still win with execution: condition, pricing, and presentation matter more than ever. If you’re considering a move in Chester, Montgomery, Philadelphia, or Lancaster County, the best strategy is to pair market timing with a strong launch plan.

The takeaway: not a guarantee, but a potential tailwind

No single Fed decision “sets” mortgage rates. But the combination of:

-

multiple rate cuts,

-

weaker confidence in employment data, and

-

supportive liquidity operations

…can be a recipe for lower yields and calmer rate conditions, which is often friendlier for the housing market.

If you want a quick plan based on your timeline (buying, selling, or both), we’ll run the numbers and give you a clear next step.

Want a local pricing + rate strategy for your neighborhood?

DM “ANALYSIS” or message The Joe Johnbosco Team for a quick consult.

3 quick social snippets to promote the blog

-

“The Fed moved again—and mortgage rates may feel it next. Here’s what it could mean in Philly Metro.”

-

“Rates don’t follow the Fed… they follow the bond market. This week’s signals matter more than most people realize.”

-

“Buyers + sellers: this might be the ‘calmer rates’ setup you’ve been waiting for. Full breakdown in the blog.”

Context sources (for your internal reference): Federal Reserve FOMC statement (Dec 10, 2025) and NY Fed operating policy notes on reserve management purchases; reporting on the third 2025 rate cut and jobs-data concerns from Reuters/WSJ/Investopedia. The Wall Street Journal+4Federal Reserve+4Federal Reserve Bank of New York+4

Categories

Recent Posts