What’s Included in Your Monthly Mortgage Payment? Understanding PITI, PMI, and More

When you buy a home and take on a mortgage, your monthly payment is more than just repaying the loan — it’s a combination of essential costs bundled into a single monthly obligation. If you’ve ever wondered what exactly you’re paying for each month, let’s break it down in detail.

🧾 The Components of a Mortgage Payment: PITI

Most mortgage payments are made up of PITI — Principal, Interest, Taxes, and Insurance. Additional costs, such as Private Mortgage Insurance (PMI) and Homeowner’s Association (HOA) dues, may also be part of your monthly bill.

1. Principal

The principal is the actual loan amount you borrow from your lender — not including interest. For example, if you take out a mortgage for $350,000, that figure is your principal.

Each monthly payment reduces your loan’s balance. In the early years, your payment is applied mostly toward interest, but over time, more of it is applied to the principal.

2. Interest

Interest is the cost of borrowing money, expressed as a percentage of your loan amount. It’s determined by:

-

Your credit score

-

Loan type (e.g., fixed or adjustable)

-

Market interest rates at the time of closing

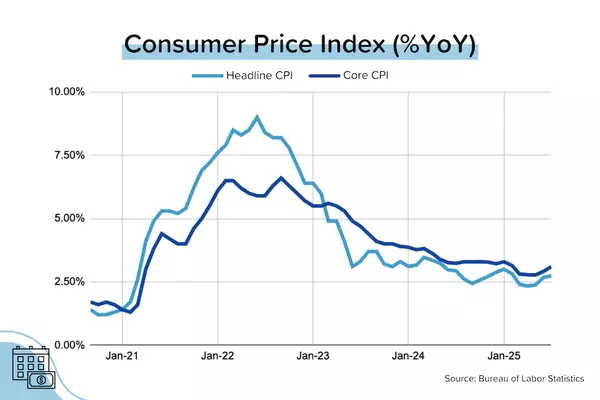

In 2024, average 30-year fixed mortgage rates in the U.S. have hovered around 6.6%, while 15-year fixed rates are closer to 5.9%, according to Freddie Mac (www.freddiemac.com).

3. Property Taxes

Taxes are based on the assessed value of your home and are paid to your local government to fund public services like schools, police, and infrastructure.

In most states, property taxes are paid twice a year. For instance, in Pennsylvania:

-

First installment due: March 31

-

Second installment due: September 30

Tax rates vary widely. As of 2024:

-

California's average effective property tax rate is about 0.71%

-

Texas averages 1.60%

-

New Jersey is the highest at 2.21% (Source: www.tax-rates.org)

If your down payment is less than 20%, your lender may require an escrow (impound) account. This ensures property taxes are collected monthly and paid on time.

4. Homeowner’s Insurance (Hazard Insurance)

Lenders require you to carry hazard insurance, which protects your home against loss from fire, storms, theft, and other covered events.

Typical homeowner’s insurance costs vary by state, averaging about $1,428 annually in the U.S., or $119/month (Source: www.valuepenguin.com).

Like taxes, insurance premiums may also be collected through an escrow account.

5. Private Mortgage Insurance (PMI)

If your down payment is less than 20%, you’ll likely need Private Mortgage Insurance (PMI). This protects the lender in case you default on your loan.

PMI typically costs between 0.5% and 1.5% of the original loan amount annually. That’s about:

-

$70 to $210/month on a $200,000 loan (Source: www.bankrate.com)

Good news? PMI is not forever. You can usually request cancellation once your loan balance falls below 80% of the home’s appraised value. By law, it must be removed once you reach 78% loan-to-value (LTV).

⚡ Bonus: HOA Fees

If your home is in a community with a Homeowner’s Association, monthly dues may cover amenities like landscaping, snow removal, pool maintenance, and security.

National average HOA fees range from $200–$400/month, though luxury communities can exceed $1,000/month.

💡 Can You Pay Off Your Mortgage Early?

Absolutely. Most lenders allow early repayment without penalty, though it's best to confirm this in your mortgage agreement.

How to accelerate repayment:

-

Make an extra payment annually

-

Pay a little extra each month and specify it goes toward principal

-

Use tax refunds or bonuses for lump-sum payments

Early payoff reduces the total interest paid over the life of the loan — potentially saving you tens of thousands of dollars.

🏡 Wrapping Up: Know Where Your Money Goes

Understanding the full scope of your monthly mortgage payment gives you the confidence to budget wisely, avoid surprises, and plan for the future.

Whether you're a numbers-driven buyer (Compliance), a big-picture thinker (Dominance), a family-focused planner (Steadiness), or a lifestyle-driven decision maker (Influence), knowing what’s behind your monthly bill ensures you stay in control of your homeownership journey.

Categories

Recent Posts